The Daily: SEC's Paul Atkins unveils plan to clarify which tokens count as securities, Circle explores native Arc token, and more

Quick Take

- Securities and Exchange Commission Chair Paul Atkins unveiled plans for a new “token taxonomy” to clearly define which cryptocurrencies qualify as securities under the agency’s evolving digital asset framework in the months ahead.

- Circle said it is “exploring the possibility” of a native token for its Arc Layer 1 blockchain, a stablecoin-centric network that launched on public testnet last month.

The following article is adapted from The Block’s newsletter, The Daily, which comes out on weekday afternoons.

Happy Wednesday! Bitcoin briefly bounced then slipped below $102,000 again this morning as profit-taking and Fed uncertainty deepen, with analysts suggesting divisions over a December rate cut are dampening risk appetite and putting $100,000 back in focus as key support.

In today's newsletter, SEC Chair Paul Atkins unveils a plan to clarify crypto securities rules, Circle is exploring a native token for its Arc blockchain, Visa now supports stablecoin payouts for creators, JPMorgan rolls out JPM Coin on Base, and more.

Meanwhile, Hyperliquid pauses deposits and withdrawals amid POPCAT trading scheme speculation.

Let's get started!

P.S. Don't forget to check out The Funding, a biweekly rundown of crypto VC trends. It's a great read — and just like The Daily, it's free to subscribe!

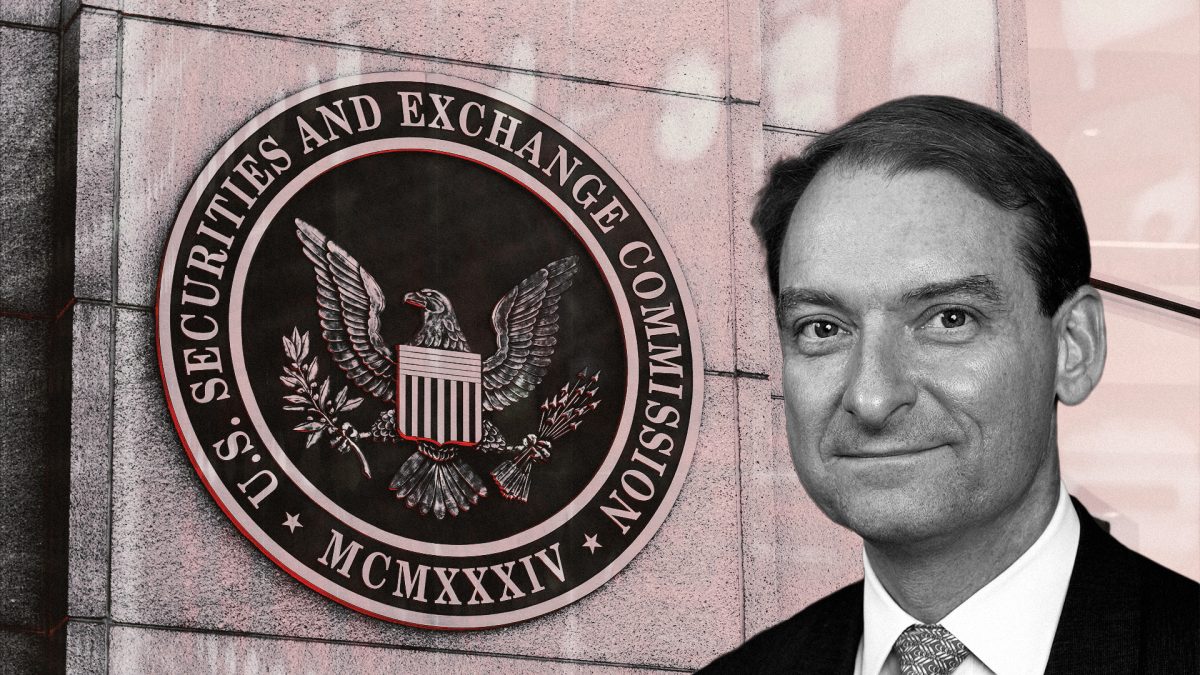

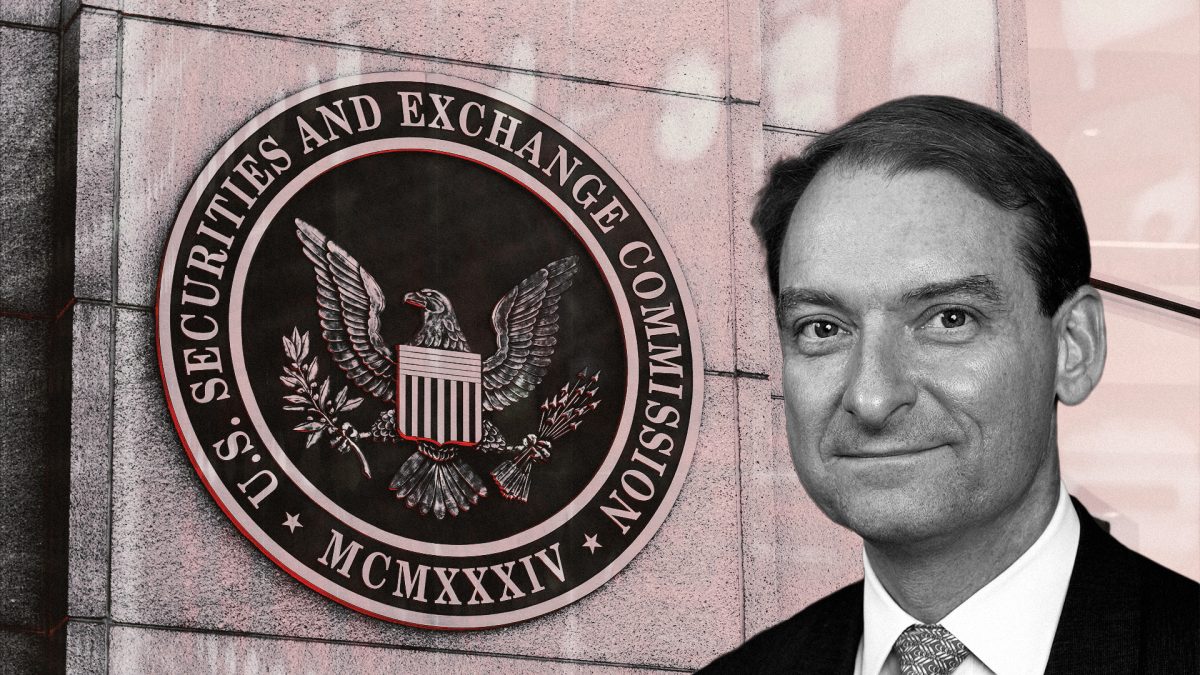

SEC Chair Atkins unveils plan to clarify which tokens count as securities

Securities and Exchange Commission Chair Paul Atkins unveiled plans for a new "token taxonomy" to clearly define which cryptocurrencies qualify as securities under the agency's evolving digital asset framework in the months ahead.

- The taxonomy will still be rooted in the now-infamous Howey Test but account for the fact that tokens can evolve beyond investment contracts as networks mature and control decentralizes.

- The new framework, part of the SEC's "Project Crypto" initiative, marks a shift from the perceived regulation-by-enforcement approach under prior chair Gary Gensler toward clearer, rules-based guidance.

- However, he stressed that it "is not a promise of lax enforcement," reaffirming that cases of fraud and tokenized securities will remain under SEC oversight.

- Atkins said the Commission's efforts aim to complement ongoing Congressional work on crypto market structure bills, not replace legislative action.

Circle explores native token for Arc network as Q3 shows sharp growth in USDC supply

Circle said it is "exploring the possibility" of a native token for its Arc Layer 1 blockchain, a stablecoin-centric network that launched on public testnet last month.

- The disclosure came as the firm reported total revenue and reserve income of $740 million and net income of $214 million in the third quarter, with USDC circulation up 108% year-over-year to $73.7 billion.

- Adjusted EBITDA was $166 million, up 78% year-over-year, with adjusted operating expenses at $131 million in the quarter.

- Management also raised Circle's 2025 "other revenue" outlook to as much as $100 million, citing growth in subscriptions, services, and transactions.

Visa now supports stablecoin payouts for creators, freelancers, and gig workers in new pilot

Visa launched a new pilot enabling businesses to send payouts directly in USDC, allowing creators, freelancers, and gig workers to receive near-instant cross-border payments in "compatible" stablecoin wallets.

- The pilot expands Visa Direct's capabilities, letting recipients choose stablecoin payouts instead of fiat — meaning faster, borderless access to earnings, the firm said.

- Only USDC is supported at launch, with broader rollout planned for the second half of 2026 as Visa scales the program and regulatory clarity advances.

- Stablecoins have become a core pillar of Visa's strategy, with over 130 stablecoin-linked card programs across 40 countries, and transaction volumes quadrupling year-over-year.

JPMorgan officially rolls out 'JPM Coin' deposit token on Base

JPMorgan officially launched its USD-denominated deposit token, JPM Coin (JPMD), on the Ethereum Layer 2 network Base after completing a proof-of-concept and pilot phase.

- Institutional clients can now use JPMD for 24/7, near-instant onchain settlement, with firms including B2C2, Coinbase, and Mastercard already completing test transactions.

- The token represents existing JPMorgan bank deposits on a public blockchain, offering regulated, KYC-compliant onchain payments for institutional clients.

- JPMorgan reportedly plans to expand JPMD to additional blockchains and is also exploring a euro-denominated version under its newly secured "JPME" trademark.

Bitcoin ETFs log best day in a month, add $524 million as cumulative trading volume approaches $1.5 trillion

U.S. spot Bitcoin ETFs logged $524 million in net inflows Tuesday — their best day in over a month — led by $224.2 million into BlackRock's IBIT.

- Since launching in January 2024, the Bitcoin ETFs have attracted total net inflows of $60.8 billion, with cumulative trading volume now approaching the $1.5 trillion milestone.

- Analysts saw the surge as a potential turning point after the worst 30-day flow period since March, though they said broader, sustained demand is still needed to break the current range.

In the next 24 hours

- UK GDP data are due at 2 a.m. ET on Thursday. U.S. CPI inflation and jobless claims figures are scheduled to follow at 8:30 a.m.

- U.S. FOMC member Mary Daly will speak at 8:00 a.m.

- Avalanche is set for a token unlock.

- Mining Disrupt Conference & Expo concludes in Texas. Bitcoin Amsterdam gets underway.

Never miss a beat with The Block's daily digest of the most influential events happening across the digital asset ecosystem.

Disclaimer: This article was produced with the assistance of OpenAI’s ChatGPT 3.5/4 and reviewed and edited by our editorial team.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.