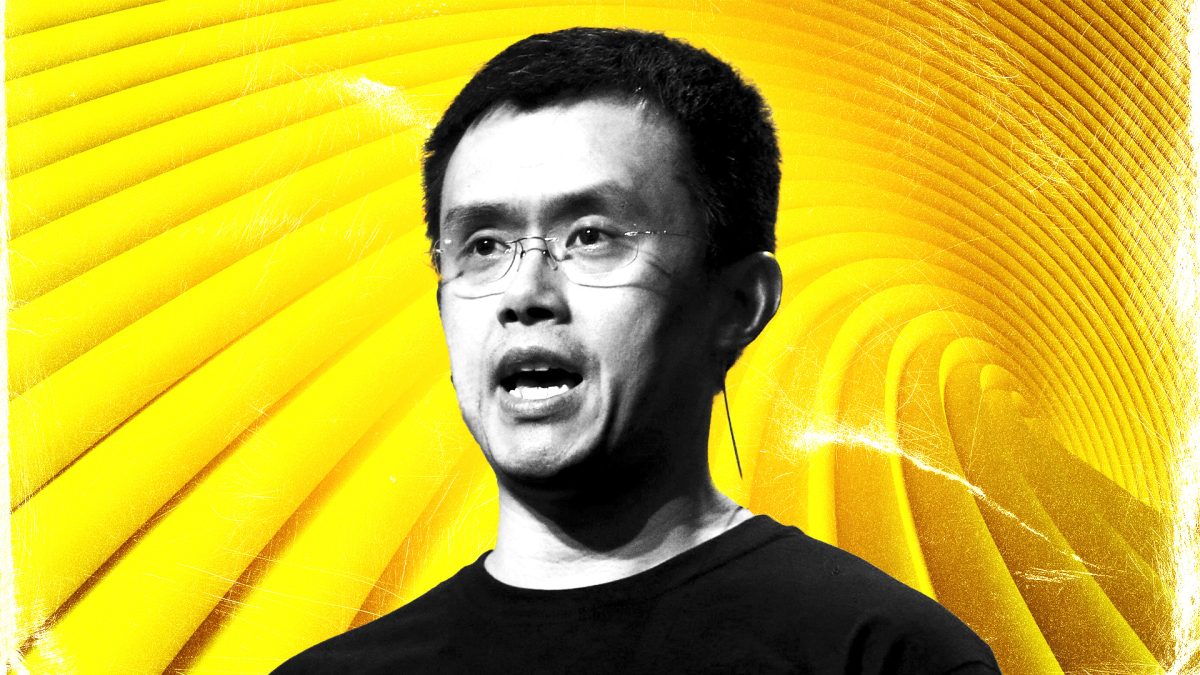

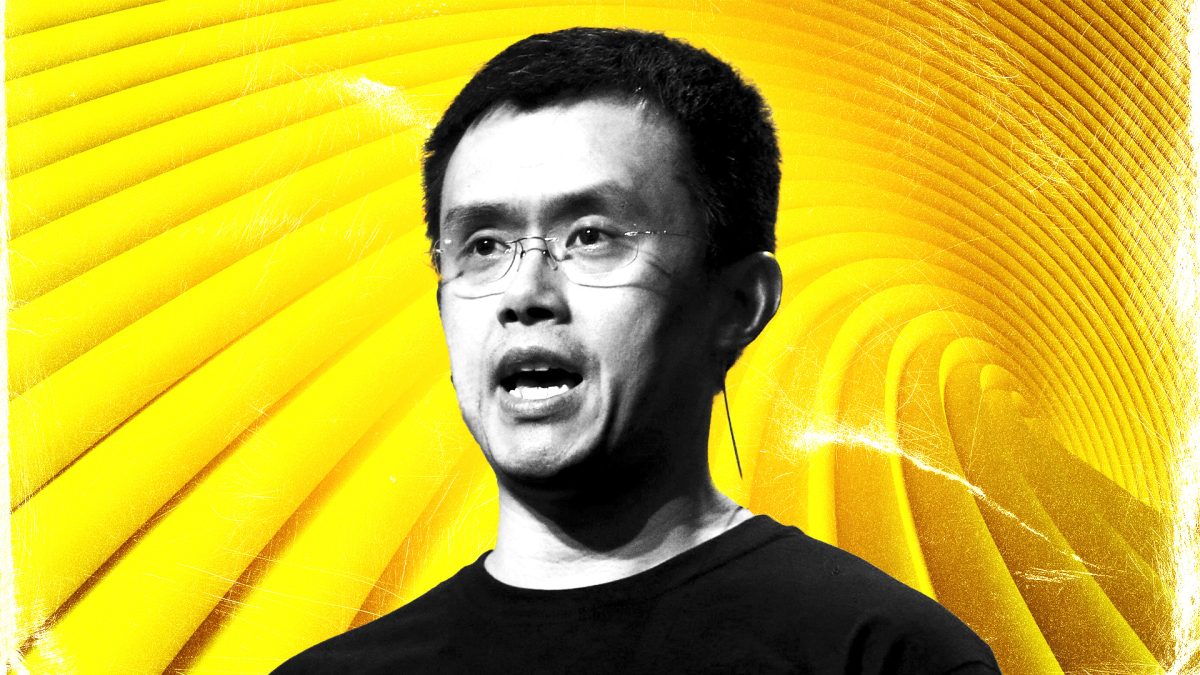

Ex-Binance CEO Changpeng Zhao's lawyer demands 'immediate retraction' from Sen. Warren over post-pardon remarks

Quick Take

- Changpeng Zhao’s lawyer, Teresa Goody Guillén, sent a letter to the top Democrat of the Senate Banking Committee this week, asking for a retraction.

- Last week, Trump pardoned Zhao after he pleaded guilty in 2023 to failing to maintain an “effective anti-money laundering program.”

Former Binance CEO Changpeng Zhao is pushing back against statements made by Sen. Elizabeth Warren following his pardon by President Donald Trump, and his lawyer is calling for an "immediate retraction."

Zhao's lawyer, Teresa Goody Guillén, sent a letter to the top Democrat on the Senate Banking Committee this week, requesting a retraction and the reversal of statements made in a recently filed resolution. Earlier this week, Fox News' Charles Gasparino reported that Zhao is weighing whether to bring a libel suit against Warren.

"Mr. Zhao will not remain silent while a United States Senator seemingly misuses the office to repeatedly publish defamatory statements that impugn his reputation and cause him further injury," Goody Guillén said in the letter obtained by The Block.

Last week, Trump pardoned Zhao after he pleaded guilty in 2023 to failing to maintain an "effective anti-money laundering program." He was also fined $50 million, while Binance agreed to pay $4.3 billion as part of one of the largest corporate settlements on record. Zhao was released from prison last year.

Shortly after the pardon, Warren posted on X criticizing the president's move and said that Zhao pleaded guilty to a criminal money laundering charge. Sens. Warren Adam Schiff then circulated a resolution urging Congress to block "this blatant corruption."

Although Zhao has denied a report from The Wall Street Journal, which stated the crypto billionaire had lobbied the Trump administration for a pardon, ties between the Trump-backed DeFi project World Liberty Financial and Binance have raised questions. WLF had reportedly held talks about buying a stake in Binance.

About six weeks after news surfaced about talks between Trump's team and Binance, the Abu Dhabi investment firm MGX said it would use World Liberty's USD1 stablecoin to close a $2 billion deal with Binance.

In a Dear Colleague letter obtained by The Block, Warren said Trump was abusing the Oval Office and said the Trump family has become richer since the start of the administration.

"Your insinuation that MGX’s equity purchase in Binance, whereby the consideration was a U.S. dollar-backed stablecoin issued by World Liberty Financial, somehow 'enriched' President Trump and his family is factually and economically unsound," Goody Guillén said in the letter.

"If holding USD1 constitutes unlawful enrichment, then every exchange listing that token would be guilty of the same offense," she added. "You do not allege that because you cannot."

Goody Guillén was a litigation counsel for the Securities and Exchange Commission and was previously a top contender to lead the agency. She is now a partner at Baker & Hostetler LLP.

Warren's team did not respond to a request for comment on the letter.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.